Some Thoughts on Inflation

- BedRock

- Oct 2, 2022

- 6 min read

Updated: Apr 8, 2024

Recently, the issue of inflation has been a core concern for global investors. While we are not macroeconomists, our investment approach is primarily focused on individual stocks, with a greater emphasis on macroeconomic background research. However, given the importance of this issue, especially its significant impact on key variables such as nominal growth rate and interest rates, and its current status as a focal point in capital markets, we have conducted some of our own research and reflection, which we offer for reference.

What important factors may affect the level of inflation?

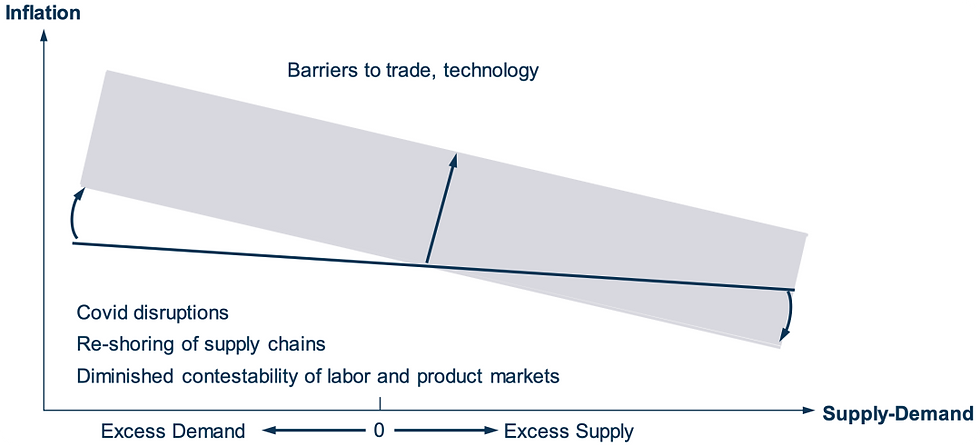

In simple terms, inflation is actually the balance between supply and demand, and it is not determined by a single factor. In the long term, human desires have no limits (of course, factors such as population and aging will have a significant impact on demand over a period of time). The cyclical changes in inflation have been discussed by many scholars and books, so I won't repeat them here. Instead, I will only discuss some possible long-term structural factors. From a long-term perspective, I agree with Zoltan's view that the world is currently at a fragile turning point, and some of the forces that have helped to produce deflation in the past have weakened, such as the globalization of product and labor markets, and the increase in competition, among others.

The potential risks in the future may lie in the restructuring of the supply chain, where safety and resilience are given more weight in decision-making, while efficiency-driven decision-making is given less weight. Additionally, there may be a slowdown in the global transfer of technology and migration, and a decrease in global competition for products and services due to various barriers that arise.

Globalization, Human Rights and Energy

Here we would like to expand on the most discussed topics regarding the impact of globalization, human rights, and energy on inflation.

Globalization and Human Rights Exchange

In short, globalization has led to the formation of a large global market, allowing for the most efficient use of production capacity. In the past, global development has been driven by globalization, which has led to fast global growth and low overall inflation due to increased productivity. In the exchange between developing countries and developed countries, it is actually the people of developing countries who sell their time and effort to provide basic products in exchange for advanced technology controlled by developed countries. This exchange efficiency has low human rights characteristics, which is why some countries that emphasize obedience and discipline may perform better during this stage.

However, after globalization has developed to a certain stage, it does bring about some challenges to this exchange, which may be amplified by some big power games, such as:

The inevitable gap between the rich and the poor and the vacuum in primary manufacturing industries in developed countries;

The difficulty of maintaining a low human rights mode after the emergence of affluent developing countries also increases significantly. It is inevitable that they will need to upgrade their industries, but they will also face difficulties in doing so, leading to the "middle-income trap";

Conflicts of interest between different countries become more apparent;

The threat of restructuring the division of labor brought about by the climb of emerging countries in the industrial chain for fortress countries.

This has led to a current trend of "de-globalization" or "regionalization".

Robots (Technology) and Human Rights

However, due to different stages of development, developed countries cannot revive their manufacturing industries by reverting to a "low human rights" model, as clearly demonstrated in the documentary "American Factory" produced by Obama and Michelle Obama's production company, Higher Ground Productions. Even with subsidies from the government, American workers would never be able to compete with workers from countries in the East or other countries with low human rights but high discipline in terms of salary and execution. Once people have already enjoyed a high-quality and highly autonomous lifestyle, it is difficult to turn back. Therefore, apart from high subsidies, the most important thing is to introduce more "low human rights" parameters in this variable, so as to thoroughly crush humanity in terms of cost and execution, in order to fundamentally compete in the manufacturing industry. (From this perspective, various vocational education programs designed to adapt to past production modes may face great risks in the face of technological progress.)

Elon Musk is currently working on a bot that could become a major game changer if successful. This is an important premise, but the frightening thing is that various automation devices and AI algorithms are not intended to make this a one-shot deal or to create a magical singularity. Instead, their progress is cumulative and iterative. That is to say, they are not trying to surpass humans in one fell swoop, but rather to form a mechanism that can learn quickly and continuously improve over time, eventually defeating humans.

Perhaps in the future, humanity's problems will ultimately be solved by advances in technology.

Energy and Regional Dispute Risk

We believe that the volatility generated by energy may not be sustained, for two main reasons.

Firstly, energy and any other commodity are essentially highly tradable (with the exception of some categories such as natural gas), so their impact may be limited in the absence of comprehensive secondary sanctions. Secondly, the cost structure of energy and commodities does not exhibit a structural upward trend, and may even face the possibility of structural decline (such as technological progress promoting exploration and extraction), which is fundamentally different from inflationary services that rely on human involvement. The maintenance of high prices but the inability to continue innovating to achieve higher prices may not be sustainable and does not have a second derivative effect, so the inflation data one year later is not affected. The key is whether inflation and the inflation of commodity prices have a transmission effect to other sectors.

Therefore, the energy and food crises caused by the Russia-Ukraine conflict are relatively short-term and can be alleviated. For example, the impact on production may cause some losses, but the impact on trade can be significantly reduced by returning to China, especially for petroleum products. Europe can also reduce its dependence on Russia by increasing imports from the Middle East. The global market is approaching balance. However, a significant risk is whether there are factors in the future that will lead to sustained inflationary pressure spreading to production.

For example, if there is a major military conflict in the Taiwan region in the next 5-10 years, and a blockade and supply disruption similar to the Russia-Ukraine conflict occurs, the world will face sustained inflationary pressure. Because it is unlikely that the world will find a replacement for China's large supply chain in the short term. Even though there are some alternative options currently available, they are far from sufficient for a comprehensive replacement.

Regenerate response

A Brief Analysis of the Recent Inflation in the United States

While we generally agree with the long-term concerns mentioned above and many of the risks mentioned by Zoltan, we still believe that at least in the near term, these may not be the main drivers of inflation. This is because factors such as the "inventory optimization" strategy mentioned by Zoltan, which may need to be reversed due to risks, lead to a decrease in efficiency as global production leverage declines. However, we may currently be in the later stage of Zoltan's perspective, where due to factors such as the pandemic and concerns about global supply chain restructuring, global finished goods inventory is already at a high level and needs to decline. Therefore, we may be seeing a downward trend in inventory cycles, which is creating pressure for declining demand (i.e. concerns about recession) and deflation.

In addition, with the significant increase in interest rates by the Federal Reserve, housing demand has sharply declined, and even the rental prices, which have been the most resilient in recent times, have started to peak and fall back.

Actually, the main reason for the slow decline in inflation levels and why the Federal Reserve is still not easing up on interest rate hikes is due to the extremely tight job market. The unemployment rate is at a historic low, and businesses are having difficulty hiring, which may put pressure on wages and lead to inflation. The effect of labor compensation is often easy to rise but difficult to fall, making inflation levels sticky.

Of course, our ability to judge this point is relatively weak, and it is difficult to determine how much the US economy needs to slow down to reverse the labor market. However, from our initial feelings, the epidemic prevention and control measures in Europe and the United States have been very sufficient, and the recovery of various service industries has basically been sufficient. As shown in the following chart, the trend line of the service industry has basically returned to its long-term trend line position. Therefore, we can preliminarily conclude that the period of most urgent labor force grabbing due to the resumption of business may have already peaked (actually similar to the frenzy of grabbing consumer goods during lockdown).

Although short-term inflation pressures remain high, consumer expectations for long-term inflation have significantly declined (although there may still be some structural inflation upward risks in the long run as mentioned earlier).

Comments