Some Thoughts on Exchange Rate Issues

- BedRock

- Oct 9, 2022

- 10 min read

Updated: Apr 8, 2024

Continuing from the previous two articles "Thoughts on Inflation Issues" and "Thoughts on Interest Rate Issues", we have also done some research and reflection on another headache-inducing issue: the pricing problem of exchange rates, for reference.

Exchange rate changes are complex and far-reaching

Compared to macro issues such as inflation and interest rates, which are already complex, exchange rate issues seem even more complicated, with more and more complicated factors affecting them. Even professional economists often miss the mark, let alone non-professional foreign exchange traders like us. As mentioned in the previous article, our research on macro complex issues is never the main investment basis, and our investment choices are more based on our research on individual companies, while research on macro complex issues is not our basis for macro investments, but rather a part of our research on the background environment of our investments.

For offshore fund investments in particular, the impact of exchange rates on investment returns may be huge and may seriously affect the investment returns of capital. This effect cannot be completely attributed to the sharp appreciation of the US dollar in 2022, as although the appreciation of the US dollar this year was huge, in fact, if we look at a longer time period, many countries' currencies have devalued significantly, which is a very significant destruction of investment returns (currency hedging is generally short-term and difficult to cross-period, so long-term investment still faces significant exchange rate risks).

As shown in the figure below, the fluctuation of some countries' currencies (especially emerging market countries) has a huge impact on foreign currency investment returns, and its degree may have already exceeded the return of investments in projects, stocks, bonds, etc. This leads to a significant country risk premium for investments in these countries and a significantly higher demand for compensation for foreign currency investment risks.

And even in some developed countries, the impact of exchange rates may also exist and not small. The recent devaluation of the yen, euro, and pound this year is a case in point.

If we do not have enough understanding or risk compensation for the exchange rate risk faced by foreign currency investment targets (including companies with a high overseas business proportion), it may also face many challenges in future investments.

Pricing system of exchange rates?

Economics has a set of introduction to exchange rate impact factors, which generally include "international balance of payments, inflation, foreign exchange reserves, interest rates, investor expectations, fiscal deficits, government bonds, and political stability, etc."

However, we think that many of these explanations are too general, repetitive, and difficult to quantify, so we prefer to classify them more simply into trade items, investment items, financing items, and balance sheet research. This can be compared to company analysis:

Trade items are similar to operational cash flows: they reflect the competitiveness of goods and services in international trade and generally have a strong persistence (based on sustainable competitiveness advantages, it is often difficult to be overthrown in the short term);

Investment items include investment cash flows, which of course include investments, but also speculation. Speculative capital fluctuates greatly, while investment-oriented is often related to investment returns based on the sustainability of different countries (such as FDI). Strong persistence; it should be noted that if a country's international reputation and trade volume are large enough, it may become a foreign country and resident's holding asset (typical of the US dollar), bringing continuous investment-oriented capital inflows and enjoying a very favorable seigniorage tax.

Financing cash flow: mainly includes various bonds and equity financing, and for relatively weak countries and enterprises, it is often priced in foreign currency;

Chart: Different country interest rate differences are one of the means of attracting funds. For example, China's bond yield has been higher than the United States for years, but recently, with the US interest rate hike, it has shown a significant reversal, which will significantly affect the investment logic of many funds relying on bond yield differences for cross-border arbitrage.

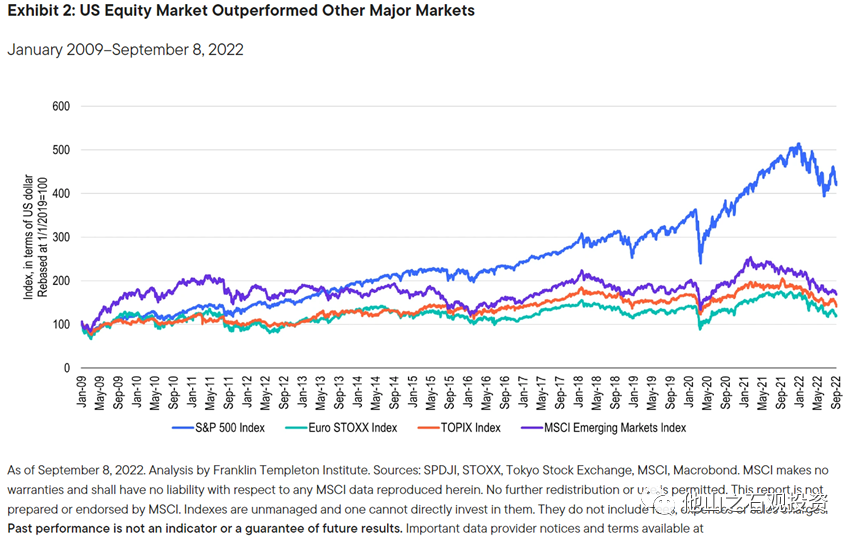

Chart:The returns on equity investment in the United States are consistently higher than in other countries around the world, whether in developed countries such as Europe or in emerging markets.

Chart:The ROE of equity investments is consistently higher in the United States than in China, which creates differences in attraction to capital. Therefore, foreign capital may require a higher risk premium when investing in China.

The concepts of foreign exchange reserves, foreign debt, current assets, and current liabilities can also be analyzed in a similar way to company analysis. Of course, they also have a direct impact on pricing, for example, if a country's central bank wants to intervene in the foreign exchange market, if it has enough ammunition, it can at least significantly intervene in the buying and selling and expected formation of the foreign exchange market in the short term.

Of course, many of the persistent factors affecting foreign exchange inflows or outflows mentioned earlier are difficult to reverse in the short term by intervention, and they may still continue to affect foreign exchange pricing, making the central bank's intervention ultimately face the situation of ammunition exhaustion and have to face a "collapse" situation. Therefore, central bank intervention can affect exchange rate pricing in the short term, but it is difficult to keep it away from its reasonable price for a long time.

Chart:The state of China's foreign exchange reserves (equivalent to the asset side)

How to determine reasonable pricing?

As mentioned above, we have discussed many factors affecting exchange rate pricing, but how much exchange rate is sustainable and reasonable? This question seems to have no single, unchanging conclusion. For example, we can't figure out how much the exchange rate between the US dollar and the euro or the Chinese yuan is reasonable, which depends on the constant rebalancing of various forces mentioned earlier, meaning that this is purely a result of a transaction.

For example, when a country's exchange rate depreciates, its export competitiveness may increase (assuming that other export-oriented countries do not depreciate competitively), investment returns may increase, and so on. Therefore, under the balance of various forces, it is possible to reach a reasonable price at that time, and this price will continue to change with the development of things.

The only thing we can do is to try to judge the direction of these changes in power, and it is difficult to accurately give a so-called reasonable price.

How much is the US dollar index reasonable?

It seems to be an impossible task to thoroughly research and determine a fair position for the US dollar index (or any currency).

Historically, even the US dollar index, which is a basket of currencies and theoretically should be relatively stable, has shown great volatility. Many psychological support and resistance levels, such as 90, 100, seem to be easily broken, and it is difficult to say clearly how high it will reach or how low it will fall.

Analyzing the US dollar index based on the framework discussed earlier, the short-term rise of the US dollar index seems to be relatively easy to explain: the slowdown of the US economy under the trade item may lead to a decrease in the deficit, while the Federal Reserve's interest rate hike increases the global relative attractiveness of US assets. But this trend depends entirely on the outcome of the transaction. Especially in the short term, the flow of capital items may far outweigh the trade items.

As mentioned earlier, trade items can be considered as the cash flow of each economy, while the flow of capital items is determined by the asset allocation decisions of each economy. Therefore, despite the negative and growing cash flow of the US under the trade item, its global leadership is still undisputed and, in the face of other regional economies that are far less stable than the US, the asset allocation preference of each economy still tends to be the US.

The strength of the US dollar index is detrimental to global sales of transnational companies, but it helps to lower their costs and reduce input-based inflationary pressure in the US, while causing input-based inflationary pressure and pressure for currency depreciation in other countries.

This issue is quite complicated, and for investors, it may only be possible to prepare for a possible re-evaluation and adjustment of the global asset allocation dynamic when the US inflation decreases and the Federal Reserve shifts its stance. Despite the negative trade balance in the United States, the global appeal of the US dollar has kept the US dollar index strong, especially in today's turbulent world, as the relative advantage of the US economy has actually increased with the development and continuation of events such as the pandemic and the Russia-Ukraine conflict. Meanwhile, the trade conditions in the eurozone and China have significantly declined compared to the US.

Compared to other regions, the US economy has a stronger fundamental structure.

For a long time, the US capital market has provided superior and sustained excess returns compared to other regions of the world.

To sum up, it is difficult to determine a conclusion on when the dollar index will reach its peak, but based on the trade and capital factors, the United States still remains the most solid and prominent compared to other regions globally, as exchange rate is a matter of preference (or rather, a comparison of the worst). Although there is ample expectation, before the change in the United States' fundamental compared to other countries internationally, we may consider that the strength of the dollar may be more likely to persist.

To further discuss the Renminbi exchange rate

similarly, it seems unrealistic to determine a reasonable Renminbi exchange rate, but we can try to work to understand its core factors of influence:

1.Trend in trade balance: China's rise has largely relied on its continually improving position in the world's manufacturing industry, and if this trend can continue, it will certainly bring sustained demand for the Renminbi and may even become a long-term holding asset in the international market. However, in the short term, this trend may face many challenges, such as the economic slowdown caused by zero-covid in China, international competitors gradually recovering from the pandemic, and a potential decline in China's export market share due to rebalancing of globalization.

2.Monetary policy: The central bank's monetary policy can also have a significant impact on the exchange rate. For example, if the central bank raises interest rates, it can attract foreign capital and increase demand for the domestic currency, leading to appreciation. On the other hand, if the central bank lowers interest rates, it can encourage capital outflows and lower demand for the domestic currency, causing depreciation.

In conclusion, determining a reasonable exchange rate for the Renminbi, like any currency, is a complex and dynamic process that depends on a variety of factors, including trade, capital flows, and monetary policy. There is no single, fixed answer, and the exchange rate will continue to be shaped by the shifting balance of these various forces.

Under these combined factors, the RMB is likely to face pressure at least in the short term.

Of course, the attitude of the central bank is also very important. The central bank clearly does not want the exchange rate to crash, but in the face of the pressure mentioned earlier, it may still secretly hope that the RMB will depreciate to relieve pressure, but it does not want the exchange rate to crash, causing a negative impact. Because, for the central bank, the importance of the domestic economy is still greater, so the interest rate vs. exchange rate may still choose to appropriately relax interest rates to protect the domestic economy. Nevertheless, considering international influence, it may hope that the RMB will depreciate slowly, with some hesitation and fluctuations, and not collapse. Given the ammunition in the hands of the central bank, at least in the short term, we do not need to doubt its ability too much.

The impact of exchange rate on investment and countermeasures

The exchange rate impact path is different due to the fact that our main investment areas are the technology and consumer sectors in China and the United States. This includes:

Direct impact

Investing in US assets with USD will not be affected by exchange rate; investing in RMB assets with USD will be damaged due to RMB depreciation relative to USD;

Investing in US assets with RMB will benefit from USD appreciation relative to RMB; investing in RMB assets with RMB will not be affected;

Equity swap calculation impact: Currently, investing in US assets with RMB through equity swap will result in US assets benefiting from USD appreciation relative to RMB in a scenario of investment gains, but the benefit will be lower than the increase in USD value; in the scenario of investment losses, it will be damaged.

Indirect impact

Exchange rate fluctuations will affect income, costs, assets, and liabilities through indirect impact.

If the business is local and does not have foreign currency assets or liabilities, it will not be affected by exchange rate fluctuations;

If there is overseas business or foreign currency assets or liabilities, it will be affected by exchange rate fluctuations. For example, US multinational companies often have costs valued in USD, but income will be affected by USD appreciation due to some international business; while companies like TSM mainly serve overseas customers, with high proportion of USD-valued costs, but many costs are local currency (such as employee salaries in Taiwan), so they will benefit from USD appreciation; if a company holds USD assets or USD debt, it will benefit or be damaged by USD appreciation. The same applies to companies with US business but holding other currency assets or liabilities."

Countermeasures

Exercise caution in investing in non-domestic currencies and globally consensus currencies (US dollars) in regional investments: Whenever possible, be more prudent in investing without a deep understanding of emerging markets and other non-dollar markets, such as Europe, as exchange rate fluctuations may be more persistent and unavoidable.

In fact, it is difficult to hedge directly. On one hand, short-term exchange rate impacts are complex and influenced by many factors of large countries' games, making it difficult to make accurate predictions, and it is also difficult to hedge directly. On the other hand, it is not possible to determine whether the RMB will depreciate or appreciate in the medium to long term, so it is not possible to counteract the exchange rate. Over a longer period of time, we tend to believe that the impact of fluctuations in the value of RMB and the US dollar is relatively neutral.

Our countermeasure is to balance the relative allocation of Chinese and American assets, so that from a business and asset-liability perspective, the US dollar appreciation has both benefits and losses, and the losses are controllable in terms of the extent of the losses.

At present, there is no good way to hedge against the exchange rate impact caused by the calculation method of equity swaps in current trading instruments.

Comments