Some thoughts on investment area selection

- BedRock

- Oct 10, 2022

- 12 min read

Updated: Apr 8, 2024

Following the previous three articles "Some thoughts on inflation issues", "Some thoughts on interest rate issues", and "Some thoughts on exchange rate issues", we have also tried to study and think about another painful problem: the choice of future investment regions, especially in today's global turmoil and the possibility of a changing situation, for reference.

Important investment regions in the world in the next decade?

First of all, it is inevitable that personal judgments are involved in the choice of future investment regions, and we may also inevitably be filled with misunderstandings and prejudices. It can only serve as our own basis for choice, and everyone can make their own judgments based on their own understanding.

First of all, we will still choose China, not only for local reasons, but also because we believe that its people's fighting spirit (the per capita GDP of 10,000 US dollars is not enough to let people lie down), the competitiveness of global education, urbanization potential, latecomer advantage, and so on have not yet reached the bottleneck period, and it is still a good investment soil without significant and persistent policy errors.

Secondly, among the global regions, we believe that the basic development in Europe, Japan and other developed countries in traditional developed countries is stagnant, while emerging developing countries also face many challenges, such as exchange rate issues mentioned in our previous article. We believe that under the current technological level and before a major conflict between China and the West, China's manufacturing advantage may make it unlikely for other countries to completely rely on copying China's path to rise. For example, many emerging countries face many shortcomings in social systems and corporate governance, which are also obstacles to investment. In addition, our research resources are insufficient, so we are more cautious about emerging markets outside of China.

Therefore, in the long run, we will still focus our efforts mainly on China and the United States.

Aging is a major long-term drag on global growth.

Japan and Europe have already aged, and their overall growth potential is limited:

China may still have the potential for development as its main focus before 2035-2040, with its overall social dependency ratio comparable to its high level in 1990, but after that, due to the lack of immigration environment in China, its overall social dependency pressure will increase dramatically, and its growth after 2035-2040 will face greater pressure.

Compared to the United States, Europe seems to face more trouble.

In addition to the aging issue mentioned earlier, Europe's debt level is already relatively high.

After the pandemic, the overall fiscal situation has worsened and there is a large degree of differentiation.

With the tightening of the US dollar, the government's interest burden may increase.

The impact of geopolitical factors will continue to be profound and far-reaching for Europe.

Europe may face restructuring from its current three-party deal-making situation.

Trump has consistently criticized other NATO countries for not paying their fair share of defense spending and has demanded that other member countries contribute more money.

Within the European Union, development is highly unbalanced, with Germany being the greatest beneficiary, while there are many complaints from peripheral European countries, which led to the situation of the UK leaving.

European faces many challenges compared to others:

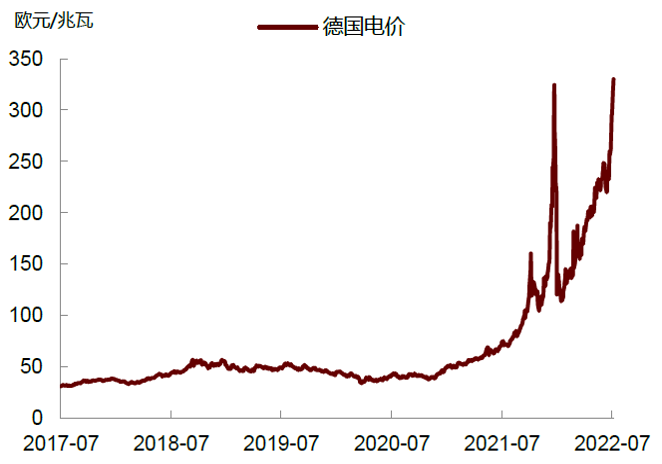

Compared to the self-sufficiency of energy in the United States, Europe faces a greater energy threat.

A significant increase in energy prices seriously affects the competitiveness of Europe's manufacturing sector.

The basic situation of the US economy is still healthy.

Although the market in 2022 mainly played with the Federal Reserve on inflation and interest rate issues, here we look at the basic situation of the US economy with a relatively longer-term vision. Of course, macro issues are a bottomless pit to write about, and here we only write some of our understanding for reference.

Despite the much higher debt ratio compared to 2007, the US still has the dominant power of the US dollar and is still the best in a global bad situation.

The basic situation in the United States does have a unique flavor: After the 2008 financial crisis, the United States took on the majority of the leverage ratios of businesses and situations through national credit, and this is probably the only country in the world that can enjoy such benefits before the true challenge to American hegemony.

Residents in other regions of the world have higher debt ratios than the United States, making the basic situation of American residents and business sectors very healthy.

If compared to net worth, the household debt ratio in the United States is lower and at a low point in the past 50 years.

Despite being troubled by high inflation, the extremely low unemployment rate and decent wage increases in the United States have not had a negative impact on the purchasing power of the general public.

In the same high inflation scenario, wages in the United States are significantly higher than in the Eurozone and Japan, and it does indeed bring the stickiness of inflation, but it is also the basis for the resilience of its consumption.

After the pandemic, trade conditions in the United States have significantly improved, while the Eurozone and China are facing challenges.

Comparing investment between China and the United States from the perspective of capital returns.

Although the apparent growth rate in the United States appears to be much lower than in China, from the perspective of investors, the more important factor is capital returns (i.e., how much return is generated for each dollar invested), and from this perspective, investment returns in the United States are far higher than in China. It should be noted that over the past 10 years, China's capital costs have continued to be higher than those in the United States, indicating that the capital appreciation in China is lower compared to the US market.

There are many profound reasons why the ROE in the US market is higher, including a more market-oriented system (in contrast, the state-owned system in China has a lower investment efficiency), higher added value in the industrial structure, and a more friendly competition environment.

In the future, China's economic growth rate will inevitably decline further, and it may still lead the United States, but for capital, the benefits of growth rate are gradually disappearing, and whether the return rate can be improved has become the key to attracting capital. Otherwise, its international appeal will be even more limited, not to mention the higher uncertainty caused by various factors such as the system.

Future regional disputes?

Please note that we are not military or political science experts, and we do not profit from researching these types of issues, so errors and biases are to be expected. We are conducting this research purely as background information for our company selection and investment.

The Russia-Ukraine conflict: may persist for a long time.

The three key factors to end a war: information, credible commitment, and domestic politics.

Recently, Hein Goemans presented a theory in his paper and subsequent book "War and Punishment": starting a war typically requires two parties, and ending a war typically also requires two parties. The theory brings in the concept of bargaining from economics. According to war theorists, the most common cause of collapse is some form of information asymmetry.

In simpler terms, one or both sides overestimate their relative strength to their opponent. There are many causes for this information asymmetry, with the most significant being that a country's military capability is usually highly confidential. Regardless, the best way to know who is stronger is to actually start fighting. The war will soon reveal the truth. Many wars end this way, with both sides reevaluating their relative advantages and choosing to reach an agreement.

However, there are other types of wars where factors other than information take precedence. One is contracts in the international system, in this case peace agreements, that have almost no enforcement mechanism. If a country truly wants to tear up an agreement, there is no arbitration court for the other party to appeal to (theoretically, the United Nations could be this court, but in practice, this is not the case). This creates the so-called "credible commitment" problem: one reason why a war may not end quickly is that one or both sides simply do not trust the other to fulfill any peace agreement reached. Dan Reiter, a colleague of Goemans, discussed this in his 2009 book "How Wars End" with the case of Britain at the end of spring 1940, after the fall of France. Britain was losing the war at the time and was unsure if the United States would come to its aid in time. However, the British continued to fight because they knew any agreement with Nazi Germany was untrustworthy. In World War II, the destruction of the Nazi regime, the modification of the German constitution, and the division of Germany solved this problem. But few wars end with such absolute outcomes.

Goemans believes that there is another overlooked factor in the end of wars, which is domestic politics. Goemans found that these leaders are easily "gambling for resurrection" and continue to wage war, often becoming increasingly fierce as victory means exile or bloodshed for themselves if they do not win.

Currently, it appears that the situation is heading in this direction, with the war potentially becoming long-lasting. In particular, the referendum in East Ukraine makes it almost impossible for this war to end quickly (of course, the intensity of the war may rise or fall, but official recognition of a ceasefire may be very difficult), on the one hand, from the perspective of Russia, this government has completed the formal procedures for East Ukraine to officially join Russia, which is officially recognized Russian Federation territory. In this case, even if passive on the battlefield, officially announcing territorial loss is something that this government cannot accept. So when Zelensky says that Putin will not be the negotiation object, he probably feels that the negotiation gap between the two sides is too huge to reach an agreement, and Putin's credibility for not fulfilling agreements is not worth talking about. For Ukraine, East Ukraine territory was originally its own territory, and it is equally impossible to accept the result of a manipulated referendum, and announcing recognition of territorial cession is also something that its people cannot accept. Therefore, the position gap between the two warring parties is too large, and neither can compromise, before the absolute crushing situation on the battlefield appears, or before a huge change in domestic politics (the leadership and government are overthrown), we are afraid that it is difficult to expect this war to end quickly.

Toward Equilibrium or Explosion?

As for the intensity and outcome of the war, it involves a lot of military professional analysis, and the details on the battlefield are full of variables and opinions. We are relatively amateur, and everyone can refer to multiple sources.

A major influence is: it will eventually follow the North and South Korean pattern, with the unsustainable consumption leading to a substantial balance of power on the battlefield (even if politically it is difficult to compromise), a long-term stalemate, or due to some leaders taking risks or unexpected events occurring, leading to extreme events (such as a nuclear war) and ultimately pulling down the entire NATO (especially the US) and exploding into the third world war?

From a rational perspective, it is difficult for Putin to achieve a substantial military reversal in Ukraine, whether in the Donbass region or outside of it, by throwing nuclear bombs, and it may even lead to worse results. This is because: 1, if thrown in the Donbass, it is equivalent to bombing one's own people on one's own territory that has just been recognized, and the impact will be difficult to eliminate for decades to come. The Donbass is too close to Russia, and the west wind will enter Russian territory, equivalent to hurting the enemy 100 and self-harming 10,000, and the benefits on the battlefield will be completely uneconomical; 2, if thrown outside the Donbass, regardless of the scale, it is equivalent to throwing in the enemy country, which has little meaning on the battlefield, but a greater deterrent effect, nakedly invading the human race, which will inevitably trigger a great rebound from the Western camp and may stimulate NATO to abandon its current position and directly participate in the war. Russia may face larger-scale anti-war sanctions globally. 3, in addition, if the nuclear bomb scale is not large, such as a tactical-level small equivalent, it may actually cause some no-man's-land (equivalent to a battlefield isolation zone), but it is basically unlikely to block the entire Russian-Ukrainian border in this way, but it will stimulate Ukraine and NATO's fighting spirit and defeat Russia's own military fighting spirit, and the overall battlefield situation will not be improved.

Therefore, from a rational perspective, Putin's best strategy is to use a nuclear stick as a threat, but not to actually use it. Of course, our analysis here is based on the assumption that Putin's decision-making is based on the long-term interests of the entire Russian nation and not on personal interests, and that his decision-making is based on a rational basis. The actual situation is influenced by many factors (such as Putin's physical condition, personal and small group interests, etc.), and it is difficult for us to make an accurate judgment. We can only say that we do not think the worst scenario is a baseline consideration, and we can do some considerations and preparations for the baseline scenario, but we actually cannot do special long-term preparation for the worst scenario (on the one hand, it is unknown, on the other hand, the cost may be too high).

The conflict between China and the United States is unavoidable?

The rise of China is bound to touch on the core interests of the United States.

Given the current situation, it seems that conflict between China and the US is unavoidable if there is no significant change in the political system. Based on America's founding principles and competitive rules, it must establish a high ground of morality, institutions, and culture in order to continuously attract talents and funds and maintain military, dollar, technology, and cultural hegemony globally.

If the American dominance is challenged or even overthrown, its influence will significantly decline, making this a core interest for the United States and something that cannot be tolerated. Even if the United States were to retreat from Asia or lose its influence around China, it would deeply affect its core interests. Therefore, for American dominance, it is difficult to bring the two dominant powers together, even if the Pacific Ocean is vast.

So even if China is sufficiently low-key and even becomes a political system like the United States, due to the continuous upgrading of China's industry, the scope of competition between the two countries is increasing, and it is feared that the conflict between the two countries will become increasingly large. Of course, it may ease the current hostile situation with ideology mixed in, but confrontation may be unavoidable.

Unbeknownst to many, both China and the US have made various preparations for a long-term conflict.

Taiwan may be a core interest for both sides and cannot be avoided.

Taiwan is at the core of China's concerns, and there's no need for further explanation. Here, we'll just briefly explain why it's also at the core of America's and even the entire Western world's interests. This is not at all comparable to Ukraine's international status, as Ukraine is simply actively seeking to join the West and has yet to be admitted, let alone be considered a core interest.

In addition to its outstanding military and geographical significance (there is a wealth of information that everyone can consult), Taiwan may be at the core of America's interests not only because it serves as a regional deterrent to China's rise, but also because its chip industry is at the core of future technological competition.

Of course, the US has just passed the CHIPS bill in an attempt to develop its own chip industry and gradually bring manufacturing back home, but this will likely take a very long time to produce initial results. Even if costs can be roughly leveled through subsidies, etc., the entire electronics industry chain is still in East Asia, and it is still too difficult to rebuild it in the US.

In particular, many downstream industries require the formation of a low human rights deficit with the US, unless One-Dragon's bot is successful in the future, then our discussion will be different. (Refer to previous articles on some thoughts on inflation issues)

Before rebuilding the US's domestic chip manufacturing capability, giving up Taiwan may mean handing over the key to the future of technology to China and also mean that the future global technology hegemony may face challenges (the US may still attract talent to rebuild, but it will take time).

Therefore, there has been a saying that TSM (Taiwan Semiconductor Manufacturing Co., Ltd) is the "god mountain guarding the island" of Taiwan, and we believe it is reasonable. Since both China and the US find it difficult to truly compromise on this issue, we expect that the conflict between China and the US over Taiwan will continue and may even escalate. Particularly considering that there may be some political motives in China to resolve this issue before or after 2027 (the details will not be expanded), we cannot rule out the possibility of future conflict between China and the West, similar to Russia and Ukraine, or even more serious situations.

Musk is actually an incurable pessimist.

No wonder MUSK is so eager to go to Mars... That's also why Ron said that the most valuable company in the future will be SpaceX, and that SpaceX's value will exceed TSLA.

Our choices and responses.

Compared to them, we are actually incurable optimists...

From a strategic perspective, our first choice is definitely the investment opportunities in China and the US, and we hope to select the best companies with growth potential. However, we have to admit that there are also a lot of risks and uncertainties involved, especially in the context of ongoing confrontations and regional disputes between China and the US.

We try to diversify and hedge our responses, and hope that time and excellent companies can at least mitigate some of the impact, but it seems there is no way to completely and cost-effectively avoid risks. Investing is always a balance between returns and risks, and there is certainly no such thing as a guaranteed and risk-free opportunity. We are still working hard and hope to persist, whether the wind is calm or the waves are high.

Comentarios