Population and Investment

- BedRock

- Dec 26, 2023

- 8 min read

Updated: Apr 3, 2024

The Impact of Population on Investment

Population issues are crucial for investment. While short-term macroeconomic and investment trends are more closely related to factors such as short-term economic cycles, confidence, and emotions, population issues are significant for long-term investments. They represent a persistent and relatively inflexible force that is challenging to alter based on people's will.

In simple terms, the potential impacts of population issues include but are not limited to:

Consumption and Investment Trends: Younger people tend to have a stronger inclination toward consumption compared to older individuals. While consumer culture is prevalent globally, younger people generally have more optimism about the future. It's challenging to expect an 80-90-year-old person to have the same desire and investment enthusiasm for the future.

Productivity: Population size, working hours, and labor efficiency are fundamental to the production supply. However, it's essential to consider factors beyond just quantity.

Innovation and Creativity: Younger individuals tend to be more creative by nature compared to older generations. The concept of "rebirth" or "reboot" that Ma Yunlong emphasizes in the context of long-term intellectual creation highlights the role of new generations in allowing intellectual growth to occur from the ground up, from a first-principles perspective.

Ambition: Younger people often possess a stronger drive to create something from nothing, a determination that extended retirement alone cannot achieve.

Urbanization, Education, Housing, and Other Influences: Birth rates and population migration patterns significantly affect urban development, education, housing, and other critical needs.

These are just a few of the potential impacts, and in reality, the effects are even more extensive. It's evident that these issues have a profound influence on the choice of investment regions and types.

Research on Population Data

Recent preliminary reports on the population data for 2023 have emerged. While these reports may not be entirely accurate, they provide some insights. Surprisingly, this data appears to be even lower than our model's predictions...

The Situation in China

One of the most shocking aspects of the current situation is the drastic decline in the marriage rate among the eligible population (currently averaging 28.7 years old). Notably, we haven't even mentioned the birth rate yet, but with the marriage rate dropping so rapidly, it's challenging to expect a high birth rate. This data, which had remained relatively stable at around 100% before 2015, has seen a significant plummet to only 50% by 2022. In other words, over the past decade, there has been a massive shift in societal norms, resulting in only half of the young people with an average age of around 29 getting married. Even when considering the delay in the age of marriage, this decline in the marriage rate is still remarkably significant.

According to preliminary research data from 2023, China's total fertility rate has dropped to 1.15. If this trend continues, and the first marriage birth rate falls from the current 1.5 to 1.2, the total fertility rate could even drop below 1, possibly to 0.8. This means that, on average, each woman would give birth to only 0.8 newborns. It is widely known that to maintain a stable population, the fertility rate needs to be around 2.1-2.2.

Based on a simple mathematical model, we calculate that China's population will gradually decrease from the current annual rate of around -3 million to -15 million by 2036 and stabilize at around -9 million by 2050. The main reasons for this decline include the rapid decrease in newborns, as well as the aging population (average age of 78) born around 1945, a period when the birth rate was low due to wartime conditions, with fewer than 10 million births per year. After 1950, the birth rate increased rapidly to over 20 million births per year. After 2030, there will be a peak in deaths for this age group, which will significantly contribute to the negative population growth.

According to our calculations, China's population will slowly decline from 1.41 billion in 2023 to 1.39 billion by 2027, with an annual decrease of -0.3% during these years, relatively moderate. However, from 2027 to 2036, it will enter an accelerated period with a potential annual decline of over -1%, reaching 1.24 billion by 2036 and 1.15 billion by 2050. Of course, there could be greater pressure on the demand for the youth market, as their negative growth will be more pronounced. Our preliminary estimate suggests that by 2027, the annual number of newborns could be around 6.5 million, 6 million by 2036, and 4.85 million by 2050.

However, assuming no major technological (such as artificial humans, industrialized reproduction, etc.) or political system changes, even by 2050, it may not be the bottom of this population cycle. This is because the expected lifespan could be as high as 85-90 years, and it would take a very long time to complete the downward cycle. Even if we assume a fertility rate of 2 (when it's actually only 1.2), the current birth rate's declining cycle run rate would only support 630 million people. Considering the actual fertility rate, the run rate for newborns might be only 400-500 million.

We expect that the marriage rate may rebound to some extent, but there are some unique factors in China that could keep this ratio relatively low. For example, the severe gender imbalance resulting from the one-child policy alone could naturally reduce the marriage rate by as much as 20%.

Furthermore, if we refer to Japan's data, the proportion of single and childless households was close to 60% in 2020, with less than 40% of households having married and had children. We cannot say that China will definitely follow the same path as Japan, but it is clear that with the current 50% marriage rate, significant rebound would require further observation.

According to this assumption, if one expects to make long-term investments and perform perpetual cash flow calculations, the supply and demand dynamics of long-term assets need to be considered more cautiously. This includes real estate, urban infrastructure development, and services primarily targeting the youth market, such as education and others. For instance, in China, the broad urban population currently stands at 920 million with an urbanization rate of 65.2%. It may seem like there is still room for growth compared to Europe and the United States, and it's possible that it could reach 70-80% in the future. However, when taking into account factors like population decline, even if the urbanization rate reaches 75% by 2036 and 80% by 2050, the urban population will likely remain around 920 million and won't increase. It's worth noting that rural populations, with the gradual passing of the older generation, may shrink even faster. From this perspective, it appears that China's infrastructure development cycle may have already concluded, with future adjustments and optimizations primarily driven by urban development levels (debt issues have not been discussed here; this discussion is focused solely on population-related factors).

From the standpoint of average age, China's average age in 2022 is 38.8 years old. According to our calculations, this age is expected to increase at a rate of approximately 0.8 years per year, reaching 42.7 years by 2027, 50.1 years by 2036, and 58.3 years by 2050. Thinking about China's average age potentially nearing 60 years in just over two decades raises significant implications.

Drawing parallels with Japan's situation, it's possible that university entrance exams might become much less competitive in the future due to the aging population and declining youth cohort.

The Situation in the United States

Compared to China, one incomparable advantage the United States has is its longstanding global reputation for immigration. Due to its relative advantages compared to many other countries, American identity remains highly sought after. Consequently, it can attract talent from around the world, including both skilled professionals and blue-collar workers. Temporarily setting aside the economic advantages that immigrants bring, in terms of population alone, before the pandemic, immigration contributed to an annual population increase of 0.4%, accounting for 50-60% of the overall population growth increment.

Compared to China, there has been a rapid population explosion in China since its liberation, surging from 542 million in 1949 to the current 1.41 billion. In contrast, the United States, with its vast living space and abundant natural resources (theoretically capable of accommodating more people), has experienced relatively slow and steady population growth. The United States has consistently had an annual birth rate of around 4 million, with relatively stable immigration controls. Its population has grown from 122 million in 1929 to the current 334 million. It is projected that it will continue to grow slowly at a rate of approximately 0.5% per year, reaching 355 million by 2036 and 375 million by 2050. If there are no significant international political or military impacts, the United States could slowly grow to a population of 500-600 million, potentially even surpassing China, although this would take a considerable amount of time, possibly until the year 2100.

In comparison, the population density in the United States remains very low.

Although the marriage rate in the United States is also significantly declining, it has not had a substantial impact on the birth rate. Perhaps this is because new immigrants in the United States have a stronger desire for childbirth?

Due to immigration and a relatively more favorable population age structure, the United States, despite reaching a median age of 38.9 years, is experiencing an increase in age at a slower pace compared to China, roughly at a rate of 0.2 years per year. It is expected to reach 41.9 years by 2036 and 44.8 years by 2050, indicating that the population will remain relatively younger compared to China. What does this mean for our industry choices in investment layout?

Relatively speaking, the age advantage in the United States will be more pronounced:

Furthermore, due to a society-wide promotion of innovation and an emphasis on individual heroism, the United States, also as a workforce, exhibits a stronger drive for autonomy, which places it at the forefront globally.

This also to a certain extent explains why democratic values, a focus on individualism, and the emphasis on personal achievement are fundamental principles in the United States' foundation as a nation.

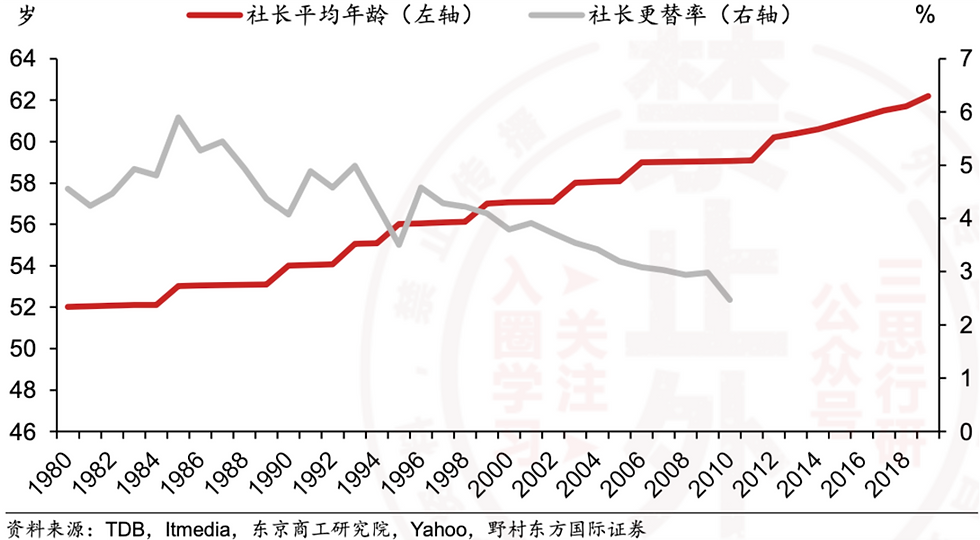

The Situation in Japan

Let's take a closer look at Japan, which is one of the most similar countries to China and provides valuable insights. Currently, Japan's birth and death rates are in negative territory, fluctuating between approximately -0.5% to -0.6%, and if we exclude the impact of epidemics, this range narrows to around -0.2% to -0.3%. This situation of negative population growth may be similar to what China will face in the coming years, but as mentioned earlier, China's situation from 2027 to 2036 is expected to far surpass this scenario.

Looking at the median age, it's quite remarkable that Japan's median age in 1990 was similar to China's today, at around 36.9 years. Due to rapid aging, Japan's median age increased at a rate of approximately 0.5% to 0.7% per year, reaching 44.3 years in 2005, which coincided with the early stages of Japan's "Lost Decades."

By 2020, Japan's median age had already reached a high of 48.5 years, close to 50 years. It is projected that the annual growth rate will remain around 0.3 years, reaching 54.2 years by 2036 and 59.3 years by 2050, similar to China's expected median age at that time.

Relatively speaking, Japan's society still has a majority of its resources in the hands of the elderly population, and its societal drive for achievement and willpower may not be particularly prominent.

So, in the long term, Japan will continue to face ongoing pressures related to population size and aging, making it challenging for the country to re-enter a phase of relatively robust economic growth.

Apart from the population

Of course, investment is not only related to the population, especially in terms of basic quantity and age (otherwise, India would already be the world's top), but also to factors such as education levels, technological advancement stages, innovation capabilities, international relations, political systems, development opportunities, social institutions, and many more. These aspects are much more complex and cannot be fully covered or addressed in this article. We'll leave these topics for future discussions when the opportunity arises.

Due to the improvement in education levels, the decline in China's competitive working-age population may occur a few years later.

In summary, we believe that the Chinese people are hardworking, well-educated, and their current state of happiness is still far from what the population aspires to achieve. The number of people who genuinely want to "lie flat" is in the minority. In fact, it can be said that the Chinese people are among the most industrious and hardworking in the world. We continue to have confidence in investing in companies led by outstanding Chinese leaders!

Comments