Latin American Investment (3) — E-commerce giant Mercado Libre

- BedRock

- Jun 25, 2024

- 24 min read

The e-commerce market in Latin America is facing new opportunities and challenges, especially with the rise of platforms like Mercado Libre (MELI). As one of the largest e-commerce platforms in the region, MELI is leading the transformation of the e-commerce industry, providing convenience and innovation for both consumers and businesses. The increase in internet access and the proliferation of mobile payment technologies in Latin America are driving more consumers to shop through online platforms. Despite challenges in logistics and payment infrastructure, MELI continues to optimize services and expand its market through investment and innovation.

Meanwhile, Chinese e-commerce companies are actively exploring opportunities in the Latin American market, attracted by the growth of the young population, changing consumer habits, and the widespread adoption of digital payments. This trend not only drives the digital transformation of the Latin American economy but also offers new opportunities for Chinese companies to expand overseas. We have observed that companies like Shein, Shopee, and Temu have already established extensive operations in Latin America, providing differentiated services and intensifying local competition.

Latin American e-commerce

Penetration Rate Still Low, Growth Potential Huge

According to the latest data from Euromonitor, the total retail sales in Latin America in 2023 were approximately $10.78 trillion, of which $158 billion was online retail, accounting for 16%. In 2023, online retail in the United States was about $11.188 trillion, and in China, it was $18.991 trillion. Latin America's online retail is equivalent to 14% of that in the United States and 8.3% of that in China. Despite having a population of 650 million, the size of the e-commerce market in Latin America remains relatively small.

There are two main reasons for this small scale: one is the relatively low GDP, and the other is the low online penetration rate. Currently, China's e-commerce penetration rate is 40%, and the United States is about 21%. In contrast, although Latin America's e-commerce penetration rate has significantly increased since the pandemic, it is still only 16%, leaving considerable room for growth.

We believe there are several reasons for the different e-commerce penetration rates in these three regions.

Differences in Retail Development Stages: The development stage of the retail sector varies. At the beginning of e-commerce development in the United States, there were already numerous large supermarkets, and the entire offline retail system was highly developed. Offline retailers such as Walmart and Costco had optimized offline efficiency to the extreme. American consumers had a good offline shopping experience with a wide variety of products. In contrast, China's offline retail development lagged significantly behind the United States. In many areas, China's retail formats had not fully matured before being challenged by e-commerce and the digital transformation of offline retail. Thus, China's e-commerce development has emerged through fierce competition with offline retail, resulting in constant changes in the retail landscape. Latin America, on the other hand, does not have as developed an offline retail sector as the United States. Although e-commerce in Latin America started early—Mercado Libre began its e-commerce operations in the region as early as the last century—the internet penetration rate in Latin America has been relatively low, limiting its reach.

Differences in Fulfillment Costs: Another crucial factor is the difference in fulfillment costs. The high fulfillment costs in the United States are mainly due to the high labor costs in logistics and the relatively low efficiency of logistics. As a result, the combined cost of offline prices and fulfillment often exceeds the total price consumers would pay if they bought the items offline (offline price + time cost + transportation cost). Over the past 20 years, China has established the world's most advanced logistics system, capable of delivering goods at very low prices and in a very short time. Due to the hierarchical contracting system and digital/automation advantages in China's logistics, the cost of logistics has been remarkably low, with deliveries between coastal provinces typically taking 2-3 days at a cost of around 3 yuan. For e-commerce, almost all products can be sold online, and the savings from not having physical stores make online prices more attractive to consumers, naturally driving them to shop online. In contrast, Latin America falls somewhere in between. Due to underdeveloped infrastructure, logistics efficiency in Latin America is lower and costs are higher compared to China, especially in remote areas like the central-western regions of Brazil, where logistics fulfillment is more challenging. However, international courier giants such as DHL, EMS, and UPS are also accelerating their presence in the Latin American market. As competition intensifies, the quality of logistics services has improved significantly in recent years. We believe that as logistics costs further decrease, e-commerce penetration in Latin America will continue to rise, although it may not reach the penetration levels seen in China.

Characteristics of Online Shopping and Payment Habits

The largest category in Latin American e-commerce is 3C products, which include computers, communications, and consumer electronics. These products are relatively standardized, and the proportion of white-label products is low. If a platform can build a good reputation, it will gain very loyal customers. In addition to 3C products, mainstream categories also include clothing and home goods. According to Euromonitor data, the GMV (Gross Merchandise Value) for clothing in Brazil and Mexico currently accounts for approximately 11% and 17% of total sales, respectively, while 3C products account for 21% and 25%. The entry of Chinese cross-border e-commerce into Latin America has provided consumers with more product choices, especially in the clothing category.

Payment habits in Latin America are more aligned with those in Europe and the United States, with credit cards being the most mainstream payment method, both online and offline. According to UBS Evidence Lab's 2023 statistics, 64% of users choose credit cards for payments, with other payment methods including PayPal, debit cards, and Boleto. It can be said that, under the wave of digitalization, many users in Latin America have transitioned from cash payments to credit card payments. Another trend is the increasing penetration of e-wallets, with 57% of surveyed users using e-wallets, which also benefits online e-commerce platforms.

Tax Issues in Brazil and Mexico

According to data from the Central Bank of Brazil, the total value of low-value imports in Brazil was approximately BRL 13.1 billion in 2022 and about BRL 10.1 billion in 2023. While these figures may not fully reflect the entire market, they suggest that cross-border low-value imports accounted for about 5.7% of Brazil's core non-food retail market in 2023, down from about 8% in 2022. According to Goldman Sachs estimates, assuming these imported goods are primarily sold online, this implies that imported goods make up around 20% of Brazil's core online retail market (excluding food). Although this percentage is not as high as in Southeast Asia, it has significantly impacted local Brazilian sellers. Consequently, the Brazilian government has continuously adjusted policies to levy tariffs over the years.

On August 1, 2023, the Brazilian Compliance Program (Programa Remessa Conforme - PRC) officially came into effect. Under the PRC registration system, Brazilian buyers purchasing cross-border parcels worth USD 50 or more through platforms are still required to pay a 60% import tax, plus a 17% ICMS tax, resulting in an effective tax rate of approximately 92%. Cross-border parcels worth less than USD 50 are exempt from import tax and only subject to a 17% ICMS tax. Joining the PRC offers special customs treatment, including priority processing, reduced inspection rates, use of PRC labels, and dedicated support.

ICMS (Imposto sobre Circulação de Mercadorias e Serviços) is a state tax in Brazil, similar to a value-added tax (VAT). In simple terms, ICMS is levied on the circulation of goods. Any transfer of goods, even within the same company, as well as goods sent to exhibitions, gifts, and samples, must pay ICMS. Each state has different tax rates, so cross-state trade must consider these rate differences. This tax is imposed equally on both local and cross-border sellers.

However, on May 28, 2024, the Brazilian House of Representatives advanced a bill to impose a new 20% import tax on international online purchases under USD 50, a rate significantly lower than the initially proposed higher rates. This proposal was passed on June 6, imposing a 20% tax on cross-border goods under USD 50. Initially, a 60% tax rate was proposed, but this was deemed unfavorable for consumers, leading to an internal agreement on a 20% rate.

Additionally, the Mover Program in Brazil has suggested new tariff policies, potentially offering a USD 20 import tax exemption for goods valued between USD 50 and USD 3000. For example, a USD 60 transaction currently incurs a 60% tax, resulting in a USD 36 tax, which, after a USD 20 discount, would effectively be USD 16, lowering the effective tax rate to 26.7%. However, the Mover Program policies have yet to be implemented.

Brazil's policies on cross-border e-commerce have been a significant concern for sellers due to their instability and frequent changes, leading to high uncertainty in inventory management. Why do Brazil's tax policies change so frequently? On one hand, domestic inflation has remained high post-pandemic, with rising product prices putting economic pressure on local consumers, driving strong demand for low-cost cross-border goods. On the other hand, low-cost cross-border goods significantly impact local industries, particularly in clothing and low-end electronics. Local businesses oppose excessive low-cost dumping. Additionally, the government seeks more tax revenue to address the growing fiscal deficit. The interplay of these forces leads to significant internal debates over tax issues.

In Mexico, the situation is similar to Brazil. On August 15, 2023, the President of Mexico signed an administrative order amending the General Import and Export Tariff Law, increasing import tariffs on 392 customs codes for products such as steel, rubber, glass, textiles, and ceramics, with rates ranging from 5% to 25%. This order took effect on August 16, 2023, and will remain in effect until July 31, 2025. The Mexican government believes it is necessary to increase import tariffs to protect domestic industries, especially since sectors like textiles, clothing, and footwear were severely impacted during the pandemic. On April 22, 2024, President López of Mexico signed a decree imposing temporary import tariffs of 5% to 50% on 544 items, including steel, aluminum, textiles, clothing, footwear, wood, and plastic products, effective for two years.

Currently, in Mexico, imported goods valued under USD 50 are exempt from import taxes. However, the National Association of Supermarkets and Department Stores (ANTAD) recently proposed regulating Chinese imports sold through e-commerce channels, arguing that the USD 50 tax exemption policy affects Mexico's tax revenue and impacts local businesses. This proposal has yet to be implemented. Additionally, cross-border e-commerce sellers in Mexico can reduce their 16% VAT and 20% income tax by registering for an RFC. For long-term operations in Mexico, registering for an RFC is essential.

In the long run, we believe that Brazil, Mexico, and even the entire Latin American region will lean towards trade protectionism. As consumer conflicts gradually resolve, tariff increases are likely. This is why companies like Shopee and Shein are actively seeking localization in Latin America, establishing local warehouses, and collaborating with local sellers.

MELI

Mercado Libre is a Latin American e-commerce and payment company headquartered in Argentina, but it operates in Brazil, Argentina, Mexico, and several other countries. Its e-commerce business functions as a marketplace for third-party goods. Initially, its payment business was a complement to the marketplace operations but has since expanded to other websites and the offline world. Currently, MELI has 145 million active users out of a total population of 650 million in Latin America, achieving an active user penetration rate of 22%. Unlike other e-commerce platforms, merchants can reach consumers in different countries with just one account on MELI.

MELI primarily revolves around its e-commerce business, Mercado Libre, and its payment business, Mercado Pago, which include six sub-business lines:

Marketplace: Mercado Libre's main e-commerce platform

Logistics: Mercado Envios, responsible for platform logistics

Shops: Mercado Shops, an online store setup similar to Shopify

Advertisement: Mercado Ads, the platform's advertising business

Payments: Mercado Pago, the online payment business

Credits: Mercado Credito, the credit business

Although there are many business lines, all of them are essentially developed around the core e-commerce business.

Marketplace E-commerce

In 2023, MELI's GMV (Gross Merchandise Volume) reached $44,350 million, with Brazil accounting for 37%, Argentina 29%, and Mexico 17%. These three countries cumulatively represent 83% of MELI's e-commerce business. Mexico's GMV share has gradually increased from 7% in 2015 to 23% in 2023. The GMV growth rate in Mexico also indicates that MELI's growth in Mexico is significantly higher than in other regions. However, in FX-neutral GMV growth, Argentina's growth rate is the fastest, reaching 235% in Q4 2023. This is primarily due to the impact of currency devaluation, which significantly reduces the value when converted to USD.

In terms of item sold growth, Mexico also has the fastest growth rate among the countries. The ASP (Average Selling Price) has fluctuated significantly, dropping from $55.4 in 2015 to $29.1 in 2020. In recent years, the growth rate has started to recover, with the ASP reaching $31.9 in 2023. The high ASP is mainly due to the predominance of 3C products (computers, communications, and consumer electronics) on the platform, which naturally have higher prices. The slight decline in ASP may be due to changes in the internal price structure of products on the platform.

From a business model perspective, MELI operates both 3P and 1P models. In 2023, 3P accounted for 96.3% of MELI's business, with a take rate of 16%. The take rate for 1P is 87%, resulting in an overall take rate of 18%. By country, Brazil has the highest take rate, followed by Mexico, with Argentina having a relatively lower take rate. In 2019, MELI realized that the value of its platform and logistics far exceeded the then-existing take rate, prompting the launch of a plan to increase the take rate.

There are 54m active e-commerce users, ARPU$823, an average of 2.5 purchases per month, and ASP$31.9. What can be seen from the historical trend is that the frequency of users' purchases has increased significantly, and ARPU has also increased significantly after the epidemic.

The number of Marketplace merchants exceeds 10m (including business or individual), and the number of active users is 54.4m. In 2019, the number of merchants was 4.2m, and the number of users was 24.1m. In 4 years (2019-2023), the number of users and merchants will double.

Logistics

The high logistics costs in Latin America are mainly due to four factors: infrastructure, geography, security, and technology. Firstly, the infrastructure in many Latin American countries, including roads, bridges, ports, and airports, is outdated or inadequate, leading to longer transportation times and increased costs. Secondly, the complex terrain and vast distances make long-distance transportation more difficult, further driving up logistics expenses. Security is another crucial factor, as some regions face significant risks of theft and hijacking, adding extra security and insurance costs. Additionally, the logistics management and technology levels are lagging, with a lack of modern logistics management systems and professional talent, resulting in inefficiencies. These factors collectively contribute to the high logistics costs in Latin America. Particularly in terms of security, logistics companies often need strong local relationships to balance local power interests; otherwise, it is challenging to ensure the normal fulfillment of goods, testing the localization and operational capabilities of logistics companies.

Since 2013, MELI has been building its logistics system. MELI has 10,000 partner locations, and its Managed Network Penetration has reached over 90% in different countries (meaning that almost all sold goods choose MELI's partner logistics). Additionally, 50% of returned goods also use MELI's Managed Network.

To improve the consumer experience, MELI has invested significant effort in building its FBM (Fulfillment by MELI) system. This system is similar to Amazon's FBA (Fulfillment by Amazon), where merchants store their products in MELI's distribution centers. When consumers place orders online, MELI's logistics team handles the delivery. This model accounts for 52% of MELI's overall logistics and is continuously increasing.

In addition to FBM, MELI utilizes cross-docking, where goods from suppliers are transported to logistics centers, sorted according to orders without needing to be shelved or stored, and then immediately sent to the collection area for dispatch to various stores. This method accounts for approximately 30-40% of logistics operations. There are also smaller proportions of same-day delivery (Flex) and slower delivery methods.

To enhance transportation efficiency, MELI launched MELI Air in 2020, which operates a dedicated fleet covering routes in Brazil and Mexico (in partnership with third parties), significantly reducing delivery times. Additionally, MELI has established MELI Places, a network similar to China's Cainiao stations, to provide convenient last-mile delivery options for users in Brazil, ensuring the best user experience.

MELI plans to invest $2.5 billion in Mexico in 2024 to expand warehouse space, strengthen the logistics network, increase loans, pay salaries, and invest in marketing and technology, aiming to replicate the successful Brazilian model in Mexico.

The following two charts more clearly demonstrate the speed and quality of MELI's logistics development. From mostly third-party deliveries in 2015 to now where the platform handles its own deliveries, and the number of items sold continues to rise. This also reflects MELI's ongoing investment in building its logistics network. In terms of delivery speed, the proportion of same-day/next-day deliveries is as high as 52%, with 75% of deliveries made within 48 hours. This is an impressive level, even comparable to the highly developed logistics network in China's Jiangsu, Zhejiang, and Shanghai regions.

Advertisement

There are three ways to advertise on the MELI platform: Display Ads, Brand Ads, and Product Ads (similar to bid ranking, directly increasing traffic). Advertisements can be placed on both the e-commerce and payment platforms, with 70% of the advertisers being white-label merchants primarily focused on driving sales. Currently, advertising revenue accounts for 1.6% of GMV, indicating significant room for growth.

Fintech

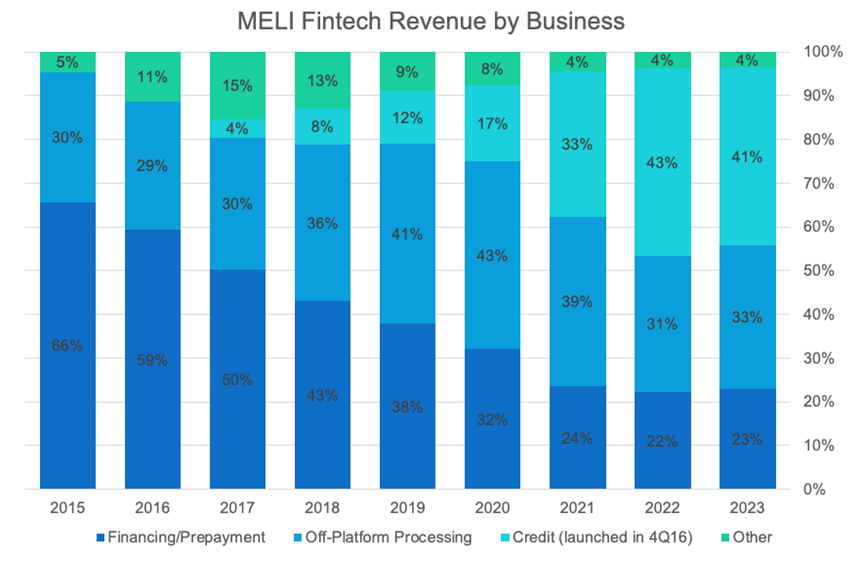

Mercado Pago is an independent financial institution under MELI, and MELI's fintech business developed from its marketplace. The total fintech revenue is $6.272 billion, with a comprehensive take rate of 3.43%. The average TPV (Total Payment Volume) per user per year is $838, of which $216 comes from marketplace transactions and $622 from other activities.

By 2023, 26% of TPV was generated within the marketplace, showing that the payment scenarios have continuously expanded to other online and offline areas. The off-platform portion previously consisted of merchant services, but now more transactions come from mPOS (mobile NFC card swiping) and Wallet (e-wallet), further demonstrating that people use MELI's fintech services beyond the marketplace. In 2023, TPV reached $182.821 billion, a 68% increase from last year's $123.633 billion. Nubank's TPV was $111.200 billion, making MELI's TPV about 1.6 times that of Nubank, indicating a relatively large scale.

The proportion of credit within MELI's business is rapidly increasing. As of Q1 2024, the total credit loan portfolio exceeded $4.4 billion, with $3.1 billion after deducting overdue amounts. Consumer loans (approximately half personal loans and half BNPL) accounted for 45% of the total, credit card balances for 35%, and merchant loans for 20% (split equally between online and in-store merchants). Personal loans and credit cards have the highest proportions, with the growth of credit cards particularly driving the overall growth of the loan portfolio.

Mercado Libre e-commerce

Market Share

According to Euromonitor data, the changes in the market share of the Latin American e-commerce market over the past decade are shown in the chart below. MELI has continually gained market share, while Americanas has lost competitiveness and gradually lost its share. The second and third largest market shares are held by Amazon and Magalu (Brazil), respectively. Shopee has also performed strongly and is now the sixth-largest e-commerce platform, just behind Liverpool (Mexico) and Falabella (Chile).

In individual countries, MELI holds at least 30% of the market share. In Brazil and Argentina, its market share exceeds 70%, while in Chile, Peru, Colombia, and Mexico, its market share ranges from 30% to 50%.

Traffic Share

In terms of traffic, Shopee's MAU (Monthly Active Users) in Brazil has surpassed that of MELI. This is due to Shopee attracting users through a combination of games and social features. For example, "Shopee Farm" rewards users in the form of "Shopee Coins," which incentivizes them to log in daily and open the app multiple times a day. Leveraging its parent company Sea's game subsidiary Garena, Shopee also offers rewards through the popular game Free Fire in Brazil. These strategies significantly increase the frequency of user visits to the platform.

In Mexico and Chile, Temu and Shein have also surpassed MELI in terms of activity. This is partly due to more promotions and discount policies attracting more consumers. Additionally, Temu and Shein offer a wider selection of categories like clothing, which means users spend more time comparing and selecting items on the platform, thereby increasing the frequency of visits.

Aside from these three platforms, MELI's traffic remains on a stable growth trajectory, and there does not appear to be a significant shift in traffic away from MELI to these competitors.

User Demographics

Different platforms tend to attract different user demographics. According to Morgan Stanley's AlphaWise report in January 2024, in Brazil, the 18-34 age group prefers using Shopee, while users aged 34 and above tend to prefer MELI. From a socio-economic perspective, Amazon serves more higher-income groups, Shopee serves more lower-income groups, and MELI has a more balanced demographic.

In Mexico, the situation is similar, with a slight difference: in Mexico, MELI's user base is primarily young people, whereas Amazon and Walmax have a higher proportion of middle-aged and older users.

Consumer Experience

From the perspective of consumer experience, Shopee and Temu have advantages mainly in terms of price and promotions. However, the quality of goods, speed of logistics, and convenience of returns and exchanges are not as good as those on Amazon, Walmex, and MELI. The main reason for this is the strategic differences among the platforms. Below, we will specifically analyze the strengths and weaknesses of MELI's various competitors.

MELI and Amazon both have their own membership systems, offering similar benefits. In addition to waiving shipping fees, they provide free subscription services for streaming media.

The membership price for MELI in Mexico is 129 pesos (7.0 USD) per month, and in Brazil, it is 17.99 reais (3.3 USD) per month.

Amazon Prime prices are 99 pesos (5.4 USD) per month in Mexico and 19.90 reais (3.7 USD) per month in Brazil.

Competitor Classification

We can categorize Mercado Libre's competitors into three types:

1. Local Latin American Retailers Transitioning to E-commerce:

Typical examples include Magazine Luiza (Magalu) in Brazil and Liverpool in Mexico. These companies leverage their long-standing reputation in offline retail to capture a significant portion of the market.

2. Amazon:

Amazon's strengths lie in its comprehensive merchant service system and superior logistics experience for consumers. Due to compliance requirements, Amazon incurs significant costs to adhere to local laws and regulations when expanding into overseas markets. This lack of localization advantage compared to Mercado Libre is a cost burden. However, Amazon's strict compliance and rigorous merchant management result in higher quality sellers but at higher costs. For consumers, Amazon's logistics experience is a core reason for choosing Amazon, which is why most high-end users prefer it. Amazon has established its FBA warehouses along the Brazilian coast and in major Mexican cities, meeting same-day/next-day delivery needs in these areas. In terms of product categories, Amazon covers a comprehensive range of 3C products and other general merchandise, although prices are generally higher, reflecting better take rates for merchants. We believe Amazon addresses the demand for high-end products and fast logistics, serving a specific demographic in Latin America.

3. Chinese Cross-border E-commerce:

Currently, about 20% of e-commerce in Latin America is cross-border, with 62% of these products originating from China. Key players include AliExpress from Alibaba, Shein and Shopee, which have been operating in Brazil for nearly three years, and Pinduoduo’s Temu, which has recently entered the Latin American market. TikTok Shop has yet to launch. Chinese companies typically compete by offering lower prices and a wider variety of apparel and low-end manufactured goods, targeting cost-sensitive mid-to-low-income consumers. In recent years, Chinese e-commerce has expanded overseas due to domestic oversupply and unmet demand amid high inflation abroad. Manufacturing in Latin America is not as advanced, and many products cannot be produced as cheaply as in China, relying heavily on imports. Except for daily necessities like food and beverages produced locally in Brazil, many e-commerce products depend on direct or indirect imports.

Competitive Analysis – Variety

Both MELI and Amazon offer a wide variety of standardized 3C products. Shein has the broadest selection in the fast fashion category. Shopee and Temu focus more on cost-effective products, covering many categories. MELI and Amazon are also actively recruiting Chinese merchants to introduce competitive products, directly competing with Chinese companies, suggesting their product variety will continue to expand.

Competitive Analysis – Speed

Fulfillment is heavily dependent on logistics. Latin America's logistics efficiency is still very low compared to China, but there is considerable room for improvement.

For local e-commerce companies like MELI, the focus is more on FBM (Fulfillment by MELI) and cross-docking, with the proportion of FBM continuously increasing. Consumer demand for speed remains high.

For cross-border e-commerce, logistics involves three stages: first-mile, middle-mile, and last-mile. First-mile logistics is handled domestically in China, which is low-cost and efficient. Middle-mile logistics mainly involve sea or air transport, with air transport being the primary method for direct shipping by merchants, which poses minimal risk. The last-mile logistics are the most challenging, with high crime rates in Latin America, including frequent theft and hijacking by local gangs. This poses significant risks for cross-border sellers. In major cities, security is relatively better, but the further into remote areas, the more difficult fulfillment becomes. Therefore, local e-commerce sellers have a localization advantage, ensuring timely fulfillment even in remote areas.

Chinese cross-border e-commerce in Latin America operates primarily through two models. The first and most common method is direct air transport, which, despite higher costs, remains profitable after adding tariffs and logistics costs. The second trend is to establish local warehousing and logistics systems. This approach addresses the instability of tariffs in Latin America, with the latest regulations raising entry barriers for cross-border e-commerce in Brazil. Localization ensures both low costs and timely fulfillment.

Shopee and Shein have both established local warehouses in Brazil and actively collaborate with local sellers to ensure stable supply chains and logistics efficiency. Shopee already has 11 warehouses in Brazil, with 90% of its sellers being local. Shein is also working with local manufacturers to replicate China's fast-fashion business model. Shein's three-year strategy includes (i) sourcing 85% of sales from local suppliers or sellers, (ii) investing 750 million reais locally, and (iii) establishing connections with 2,000 businesses, highlighting its commitment to localization. Temu, a new entrant in Latin America, follows a more extreme cost-cutting approach, focusing on offering lower prices and better user experiences. Since Temu is relatively new to the market, it has yet to establish its logistics warehouses and relies primarily on Chinese suppliers.

In January 2024, JPMorgan reevaluated the product prices and delivery times of Shopee and MELI, using São Paulo, Brazil, as the benchmark. Shopee's costs are generally lower than MELI for most products, but its delivery times are not as good. However, Shopee has significantly improved its logistics speed, reducing delivery times from 8-23 days (December 2020) to 2-15 days (January 2024). Shopee and MELI also have different free shipping thresholds, with Shopee at 69 reais (12.7 USD) and MELI at 79 reais (14.6 USD).

Competitive Analysis - "Quality"

"Quality" has two aspects: the quality of goods and the level of service. In terms of product quality, the goods on Amazon's platform are of higher quality, with MELI following closely, but the difference between the two is not very pronounced. Both platforms have stricter requirements and qualifications for sellers. Shopee, Shein, and Temu primarily offer low-cost goods. With lower average order values and the deduction of platform and logistics costs, the actual cost of the products is very low, making it difficult to ensure high quality. Additionally, since Chinese companies are mostly cross-border, returns and exchanges are more difficult, which is a common criticism of cross-border e-commerce. In contrast, Amazon and MELI offer better services, with faster logistics and better user experiences.

Competitive Analysis - "Savings"

Prices on Amazon and MELI are generally higher than those on Chinese platforms, but there are differences across various categories.

According to JPMorgan's survey data and our own statistics, we found that for lower-priced categories, Shopee has a certain price advantage. However, for higher-priced products, MELI has a relative advantage. Therefore, in terms of price range, Shopee has a price advantage in low-cost goods, and both Temu and Shopee focus more on cost-effective products, primarily lower-priced items. However, Brazil's adjustment of the tariff policy for goods under $50, adding a 20% tariff, has squeezed platform and seller profits. Whether this will impact the pricing of low-cost goods remains to be seen, but at the very least, their competitiveness has been significantly weakened.

From a category perspective, we also found that Shein has a dominant advantage in the clothing category. Although we did not find Shein's prices to be significantly lower than other platforms, the price comparison is not entirely applicable because some clothing items on Shein are not available on Amazon and MELI. Compared to offline fast fashion brands, Shein's prices still have a significant advantage.

E-commerce Monetization Rate Discussion

In the first quarter of 2024, MELI's comprehensive take rate reached 22%. Besides the take rate for 1P, the remaining part can be broken down into 3P take rate, shipping service fees, and advertising revenue. The observed trend is that the 3P take rate and advertising revenue are steadily increasing, and after experiencing losses, the income from logistics services has also started to show positive growth.

First, looking at the growth potential of the largest component, the 3P take rate, we believe that MELI's logistics provide a significant advantage, increasing user stickiness to the platform. MELI's deep cultivation in Latin America over the years, particularly in Argentina and Brazil, has established strong user mindshare that cannot be surpassed in the short to medium term. Chinese cross-border companies like Shopee, Temu, and Shein cover fewer categories, mainly competing in low-cost clothing and low-end manufacturing categories, which have little impact on MELI and cannot fundamentally affect it. Furthermore, the penetration rate of e-commerce in Latin America is still gradually increasing, indicating significant market potential, so the 3P take rate will not decline due to competition. Therefore, we predict that the 3P take rate will continue to steadily rise in the future.

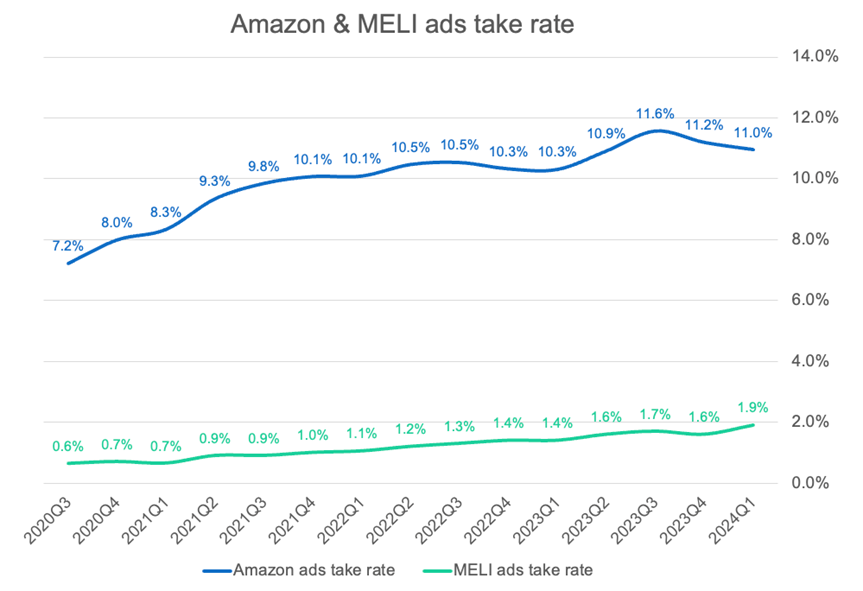

Advertising Business

Next, let's look at the advertising business. In the first quarter of 2024, the take rate was 1.9%, compared to 0.4% in 2022-2023. It increased by 0.3% in just one quarter of 2024, indicating an accelerated growth rate. According to data disclosed by MELI, its share in the Latin American digital advertising market has increased from 1.5% in 2019 to 5.0% now, showing continuous market share growth. Comparing horizontally with the advertising business of other global platforms, Amazon has reached about 11% (advertising revenue/3P GMV). In comparison, MELI's advertising business still has significant growth potential. With MELI's increased efforts to attract Chinese merchants since last year, more white-label products will be launched in Brazil and other regions. White-label products have a high demand for advertising, which will also stimulate future growth in advertising revenue.

Finally, regarding the revenue from logistics services, MELI's early investments in logistics meant that the logistics segment operated at a loss until 2020, when it began generating positive income. It's worth noting that in the first quarter of 2024, MELI adjusted the calculation method for logistics revenue and costs. Previously, many logistics services relied on third parties, but now, with more services being delivered by Mercado Envios, MELI shifted from an agent to a principal model. Consequently, previously, net revenue (revenue after deducting costs) was recorded as revenue, but now, all revenue is recorded as gross revenue, with costs included in the Cost of Revenue.

For 2023 and Q1 2024, adjusted revenues were $2,658 million and $554 million, respectively, with costs of $1,648 million and $293 million. The gross margins for logistics were 38% and 47%, respectively. Using the previous calculation method, the logistics take rate for Q1 2024 would be 2.4%, showing an improvement compared to 2023, indicating the gradual realization of economies of scale.

NOTE:Revenue is recognized on a gross basis, with any associated costs booked as cost of net revenue (as opposed to these revenues previously being booked net of costs when Mercado Libre was considered to be acting as Agent). (2024Q1 MELI earnings presentation)

Currently, the logistics share is only 4.9%, but it is expected to continue growing in the future. The first driver for this growth is the anticipated decrease in average order value (AOV). Currently, MELI's AOV is relatively high, fluctuating around $30 in recent years, so the proportion of logistics costs per item is relatively low. As MELI continues to expand its product categories, the AOV is expected to decrease, which will, in turn, increase the proportion of logistics costs. The second driver is the economies of scale that can gradually reduce logistics costs. However, MELI is still in the process of increasing penetration and attracting users, so its self-built logistics system has not yet fully realized greater economies of scale. From 2023 to Q1 2024, we have already seen an increase in logistics gross margins, and this trend is expected to continue.

Comparing MELI's and Amazon's Take Rates

Compared to Amazon's take rate, MELI's take rate is still relatively low. Amazon's overall take rate is now 44%, with the take rate excluding advertising and other revenues at around 32%. In contrast, MELI's take rate excluding advertising is 20%, which is 12% lower. Part of the reason for this difference is the contribution of logistics. Amazon's FBA significantly optimizes the user logistics experience. However, in the US and Europe, labor costs are generally high, making the logistics delivery process more difficult and costly for Amazon.

Take Rates in China and Southeast Asia

Looking at take rates in China and Southeast Asia, China's overall take rate is around 5%, with a lower proportion attributed to logistics. We see a lot of free shipping and return policies, which have almost become a norm in China. There are two main reasons for this. First, China's e-commerce market has reached a mature stage, with increased competition leading to businesses and platforms bearing the costs of logistics and return risks, which are reflected in product prices. The second, and more important reason, is China's strong infrastructure, which has driven the development of the express delivery industry. In terms of both timeliness and cost, China has a leading edge over other countries. Most goods can be delivered nationwide within 1-3 days, which is very difficult and expensive to achieve in the US if timeliness is required. In this context, having its own logistics system gives e-commerce platforms a significant advantage.

Logistics in Latin America

Turning our attention to the logistics industry in Latin America, the infrastructure is still relatively underdeveloped. However, the digital operation experience can be directly replicated from China and other regions to Latin America. We observe that countries like Mexico and Brazil are rapidly developing their national infrastructure, which is expected to lower third-party logistics costs in Latin America in the future.

Mercado Pago Fintech

Traffic Share

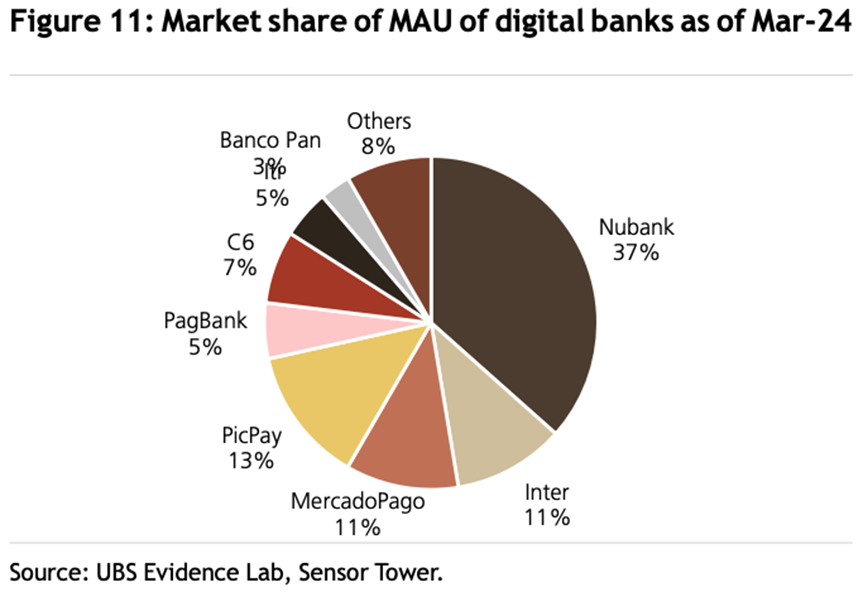

As mentioned in the previous section, many people in Latin America do not have bank accounts. With the development of digital banking, the penetration rate of credit cards has significantly increased. First, let's compare the MAU (Monthly Active Users) of all digital banks. We can see that Nubank has a market share of 37%, historically the highest, and it continues to rise. Another platform on an upward trend is Mercado Pago, with an MAU share of 11%, tied with Inter for third place. Picpay, on the other hand, has been losing market share.

If we include traditional banks in the comparison, the MAU share of this segment reaches 34%, with Nubank alone accounting for 25% and Mercado Pago accounting for 8%.

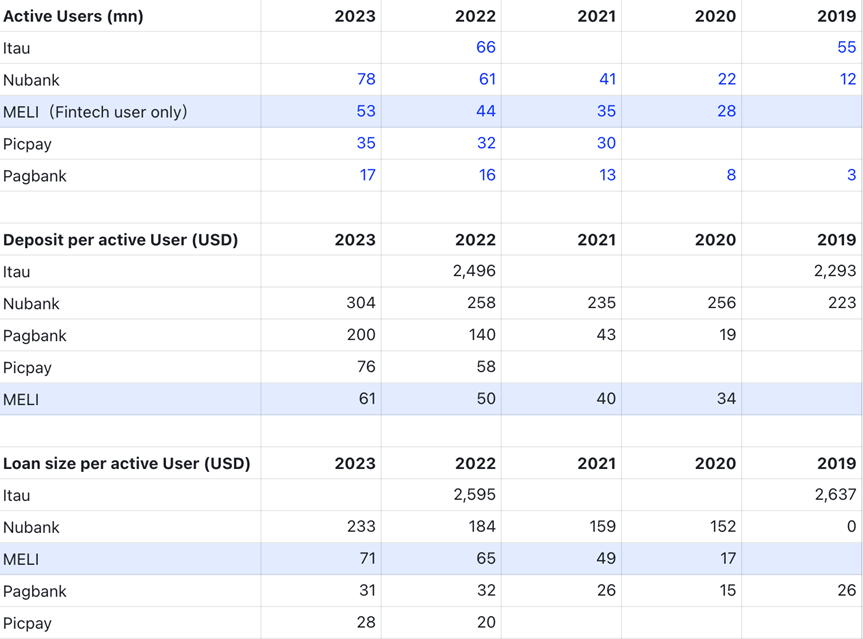

Mercado Pago Features-Wallet Attributes

MELI has around 53 million users, not significantly fewer than Nubank and Itau. However, most of the users' money is still deposited in traditional big banks. The average deposit per user for Nubank is only about one-tenth of that for Itau, and for MELI, it is only one-fifth of that for Nubank. MELI and PicPay do not have many deposits but facilitate a large number of transactions, essentially serving as transfer tools.

From the perspective of deposits, the gap between MELI and Itau/Nubank is quite evident. Itau has a stronger credit offering, and Nubank has gradually expanded from its credit card business into personal loans. However, MELI's credit offerings are currently more limited to its existing ecosystem, primarily serving users and merchants within the MELI ecosystem.

Mercado Pago Features-High interest rate and high risk

MELI's primary credit offerings are installment payments on users' bank cards or loans for small and medium-sized businesses. These users have a high default rate and belong to the long-tail market that traditional banks usually avoid. Therefore, MELI's strategy is to charge higher interest rates to ensure that after covering the cost of risk, they can still maintain significant profits. Currently, Mercado Pago's loans have an NPL (Non-Performing Loan) rate of over 90 days at 17.9%, which is significantly higher than Nubank's 6.3%. Under this model, MELI's IMAL (Interest Margin After Losses) is naturally the highest, and after deducting the funding cost, the NIMAL (Net Interest Margin After Losses) is also relatively high compared to its peers.

Mercado Pago’s Advantages and Expansion

Compared to other payment platforms, Mercado Pago's most significant advantage is the substantial payment demand driven by its e-commerce platform, one of the largest online payment scenarios. Currently, almost 100% of GMV (Gross Merchandise Volume) uses Mercado Pago's credit card payments. Additionally, MELI has expanded its payment business to offline scenarios. Presently, the TPV (Total Payment Volume) outside the platform is more than three times that within the platform, though this is still less than the fivefold ratio seen with Alipay. It is clear that Mercado Pago's credit card payment scenarios have already extended beyond the platform itself. Based on trends, the offline TPV/online TPV ratio is expected to see a slight increase in the future, but not significantly, as Mercado Pago's strategy remains focused on serving the e-commerce platform, with less effort seen in expanding offline scenarios.

Loan Scale and TPV

The assessment of loan scale is similar to TPV. We believe that most of Mercado Pago's current loans are provided to individuals and users within the e-commerce context, making them highly correlated with e-commerce GMV. Currently, loan amounts account for 9.8% of GMV and 2.3% of TPV. Due to Mercado Pago's convenience in e-commerce payments and its ability to meet the demands of the long-tail market, this proportion is expected to further increase, but not dramatically.

Interest Rate Spread

Referring to the interest rate spread analysis in the Nubank section, we similarly expect the interest rate spread to narrow further. However, because the majority of users come from the long-tail market, Mercado Pago will likely maintain an interest rate spread higher than its peers.

Comments